2024 Tax Brackets Single Filer Portal – For example, let’s say you earned $45,000 in taxable income as a single filer in 2023. How your income is taxed gets broken down into three tax brackets: 10% for the first $11,000 of your income . Many or all of the products here are from our partners that compensate us. It’s how we make money. But our editorial integrity ensures our experts’ opinions aren’t influenced by compensation. Terms .

2024 Tax Brackets Single Filer Portal

Source : www.cnbc.com

IRS Sets 2024 Tax Brackets with Inflation Adjustments

Source : www.aarp.org

IRS: Here are the new income tax brackets for 2024

Source : www.cnbc.com

IRS Sets 2024 Tax Brackets with Inflation Adjustments

Source : www.aarp.org

Federal Tax Income Brackets For 2023 And 2024

Source : thecollegeinvestor.com

Tax Brackets in the US: Examples, Pros, and Cons

Source : www.investopedia.com

Capital Gains Tax Brackets For 2023 And 2024

Source : thecollegeinvestor.com

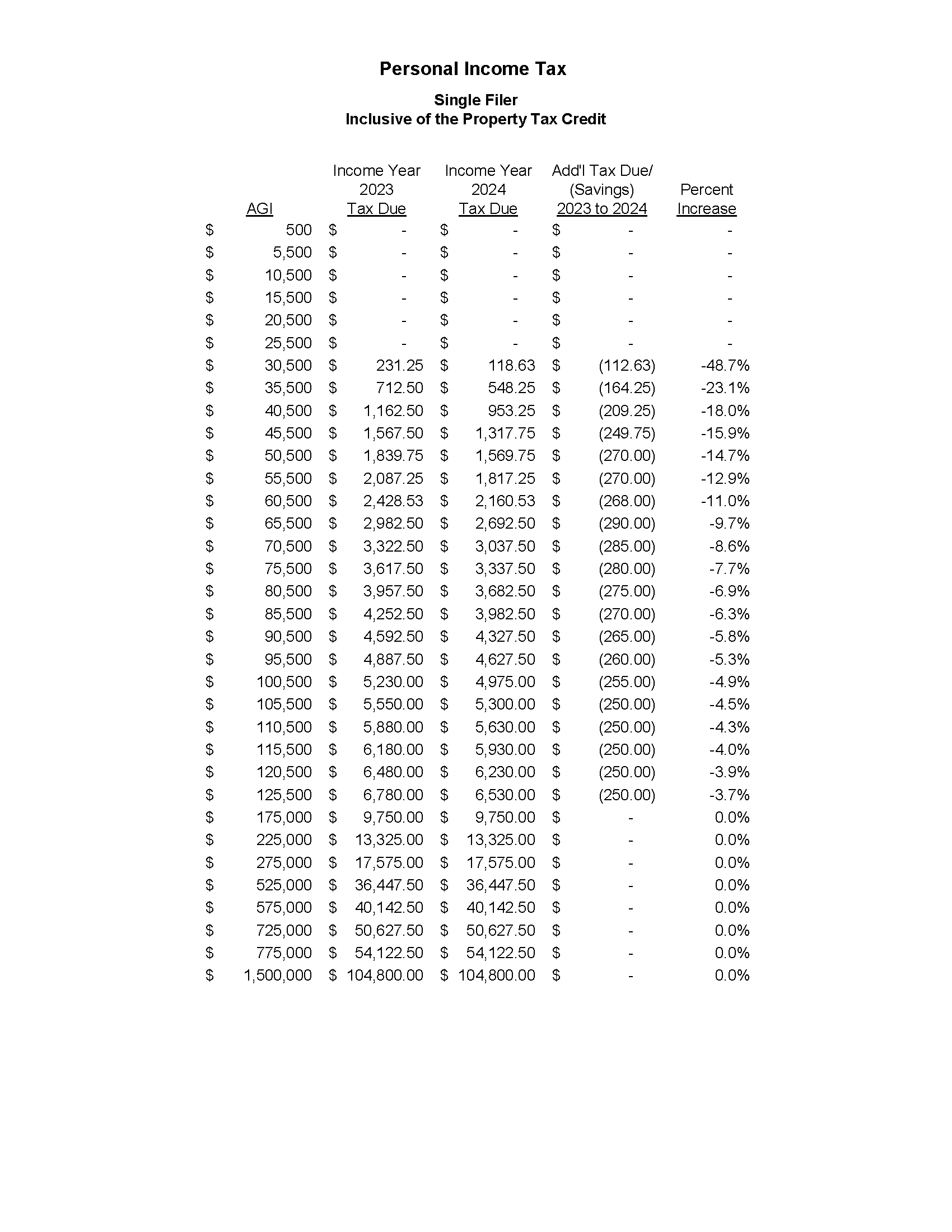

Governor Lamont Announces Connecticut Income Tax Rates Go Down

Source : portal.ct.gov

Free Tax Calculators & Money Saving Tools 2023 2024 | TurboTax

Source : turbotax.intuit.com

IRS Sets 2024 Tax Brackets with Inflation Adjustments

Source : www.aarp.org

2024 Tax Brackets Single Filer Portal IRS: Here are the new income tax brackets for 2024: Last year, the IRS announced several key tax code changes, including a boost to income tax brackets the standard tax deduction for single filers has been raised to $14,600, a $750 increase . Check out the updated 2024 tax brackets for single filers, married couples, and heads of households. Keep in mind that you’re only taxed on your taxable income. Typically, you aren’t taxed on 100% .

:max_bytes(150000):strip_icc()/Tax_Bracket-Final-1824baf32c144f4db2f9ca7c7e8a5faa.jpg)