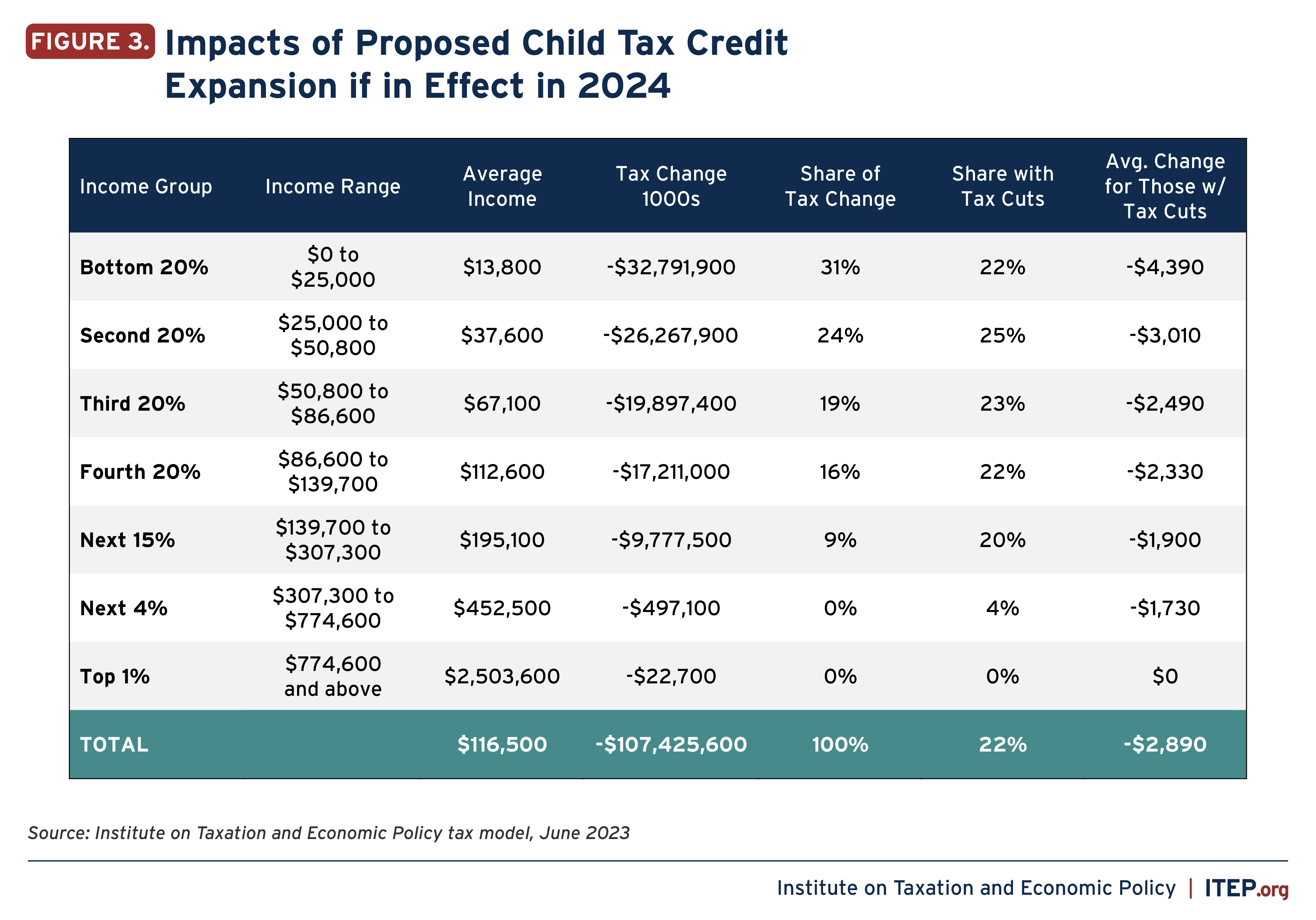

Did Child Tax Credit Go Up 2024 Schedule Chart – If you paid for childcare, you may also qualify for the child and dependent care credit. Depending on your circumstances, you can declare 20% to 35% of your childcare expenses. The maximum you can . Congressional negotiators announced a roughly $80 billion deal on Tuesday to expand the federal child tax credit that, if it becomes law, would make the program more generous, primarily for low-income .

Did Child Tax Credit Go Up 2024 Schedule Chart

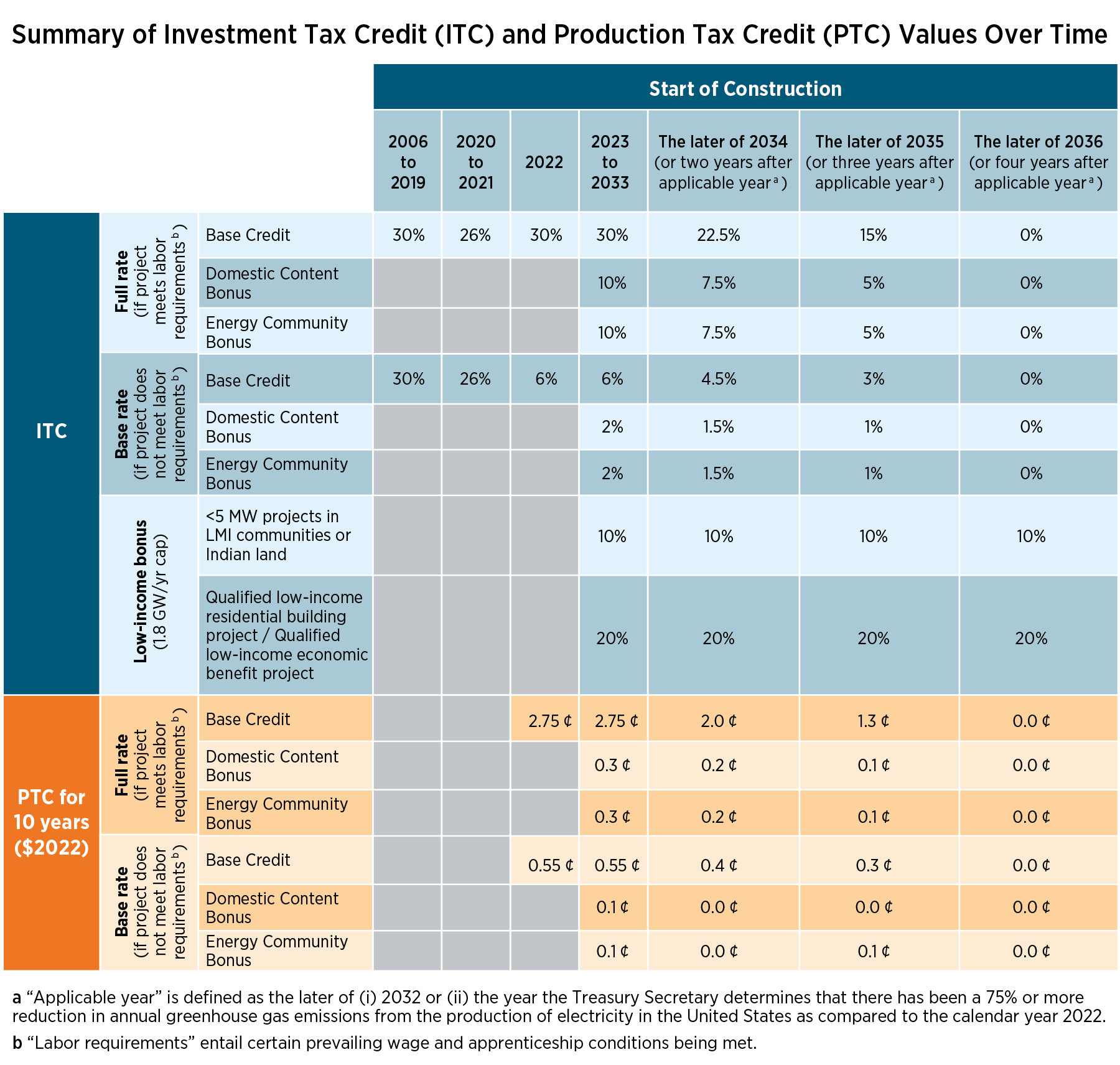

Source : www.energy.gov

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

Child Tax Credit Definition: How It Works and How to Claim It

Source : www.investopedia.com

When To Expect My Tax Refund? IRS Tax Refund Calendar 2024

Source : thecollegeinvestor.com

2023 and 2024 Child Tax Credit: Top 7 Requirements TurboTax Tax

Source : turbotax.intuit.com

Publication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov

Expanding the Child Tax Credit Would Help Nearly 60 Million Kids

Source : itep.org

Child Tax Credit 2023 2024: Requirements, How to Claim NerdWallet

Source : www.nerdwallet.com

2024 IRS Tax Refund Schedule & Direct Deposit Dates. 2023 Taxes

Source : themilitarywallet.com

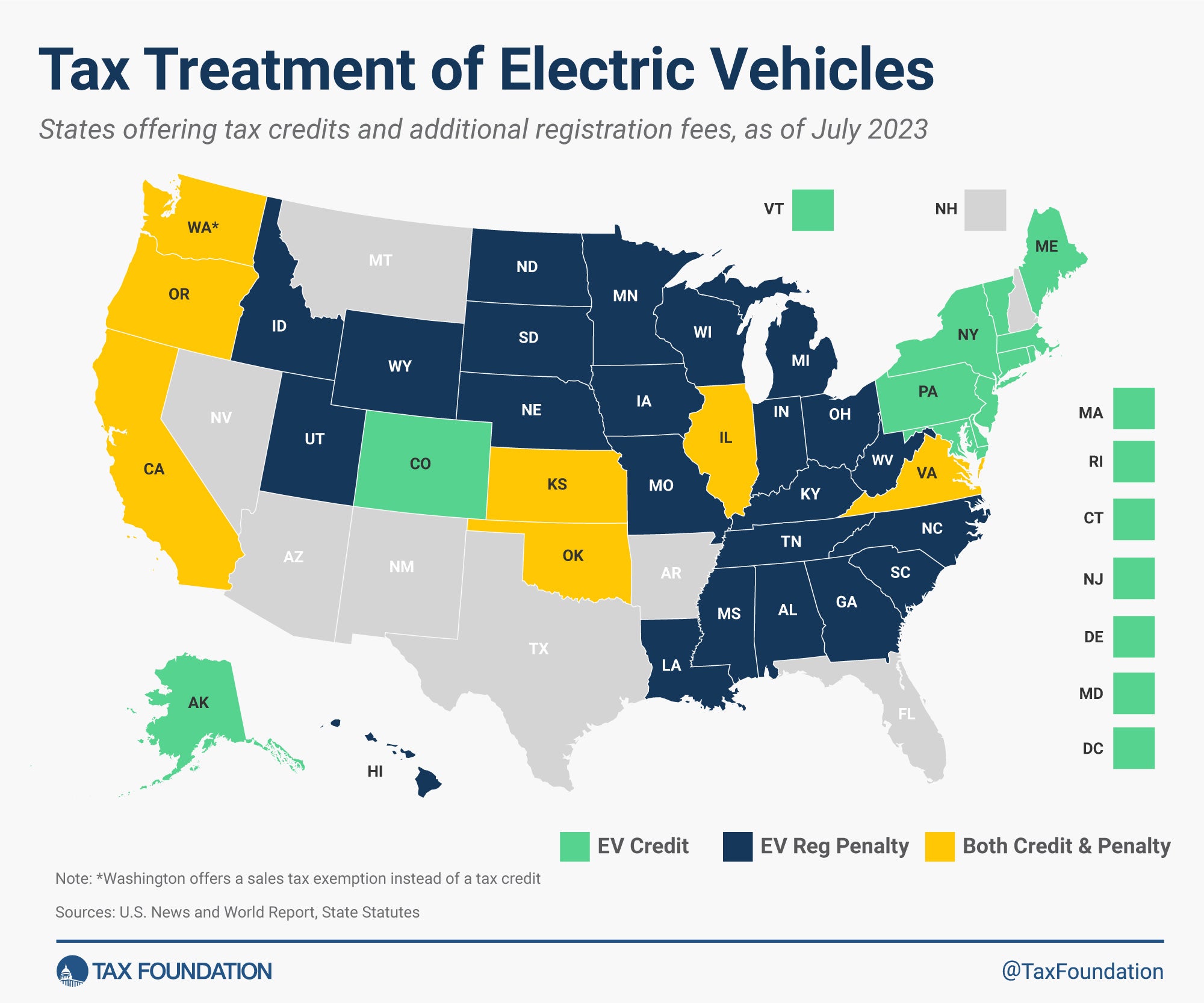

Electric Vehicles: EV Taxes by State: Details & Analysis

Source : taxfoundation.org

Did Child Tax Credit Go Up 2024 Schedule Chart Federal Solar Tax Credits for Businesses | Department of Energy: Parents and guardians with higher incomes may be eligible to claim a partial credit. Tax filers use Schedule 8812 to calculate the credit. The child would go up to a maximum of $1,800 for 2023 . Here is what you should know about the child tax credit for this year’s tax season and whether you qualify for it. .

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-1-7dd01914195e4ab2bc05ae78a40f8f0c.jpg)