Retroactive Tax Credits 2024 California State – If you paid for childcare, you may also qualify for the child and dependent care credit. Depending on your circumstances, you can declare 20% to 35% of your childcare expenses. The maximum you can . This means that the value of the credit will be distributed to the taxpayer, regardless of whether a balance is due when filing a return. In California, the state provides a tax credit to parents .

Retroactive Tax Credits 2024 California State

Source : www.shrm.org

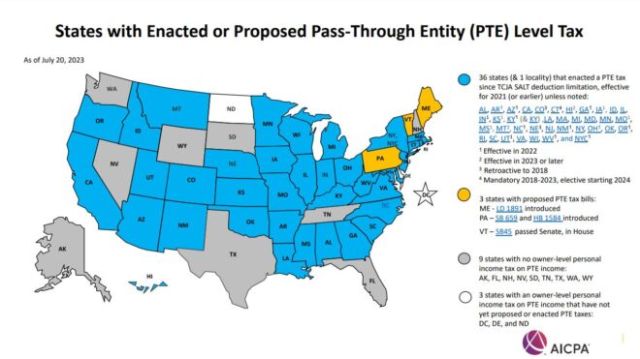

Did you know 36 states have enacted PTE tax laws to enable owners

Source : www.tafttaxinsights.com

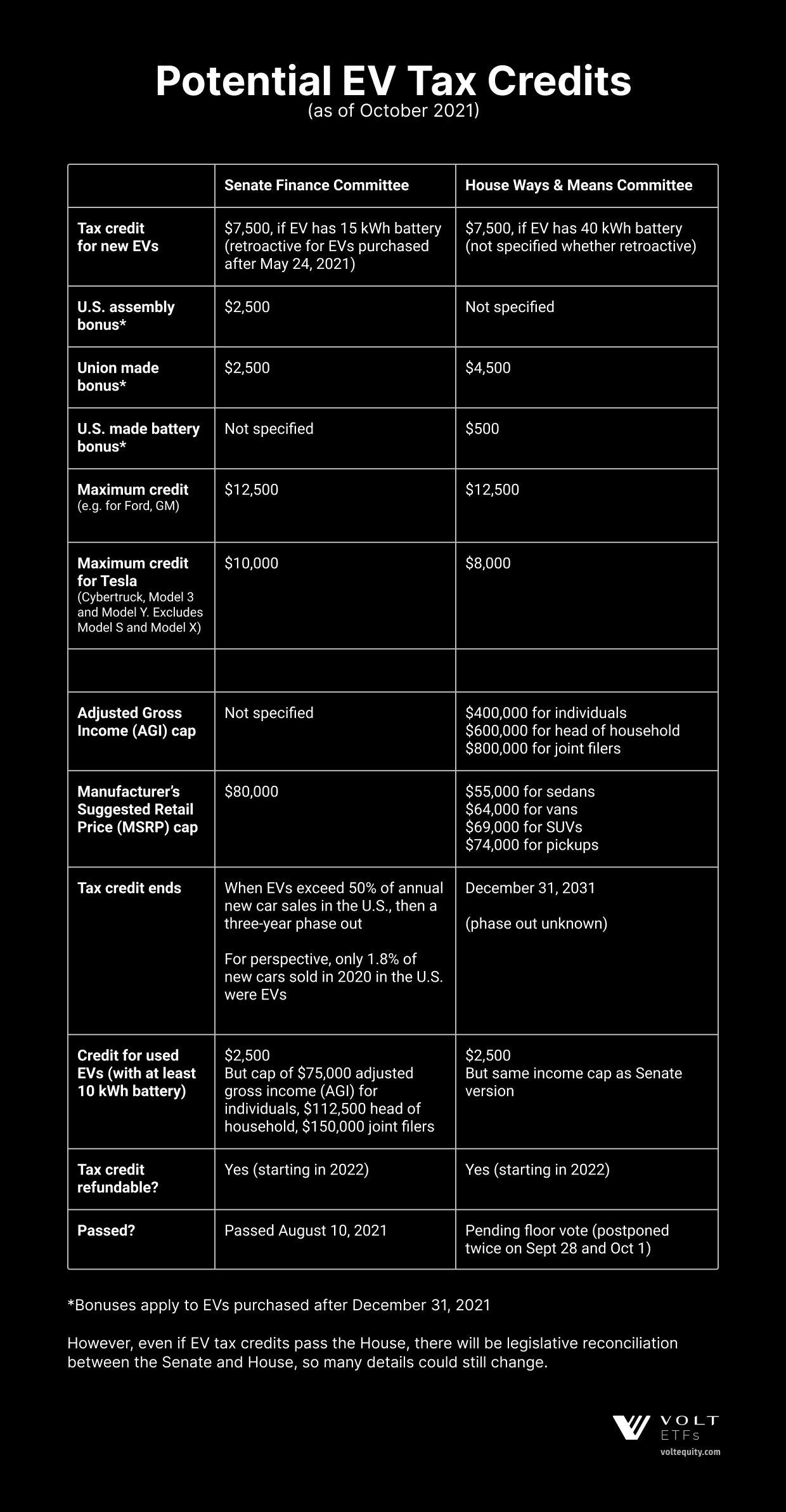

The Tesla EV Tax Credit

Source : www.voltequity.com

ICYMI | Current Developments in California, Florida, Indiana, and

Source : www.cpajournal.com

Clean Energy Business Network | Washington D.C. DC

Source : www.facebook.com

FUTA Credit Reduction: Impact on California Businesses in 2024

Source : californiapayroll.com

Did You Know 36 States Have Enacted PTE Tax Laws To Enable Owners

Source : www.mondaq.com

San Diego Unified school board OKs raises, teachers contract The

Source : www.sandiegouniontribune.com

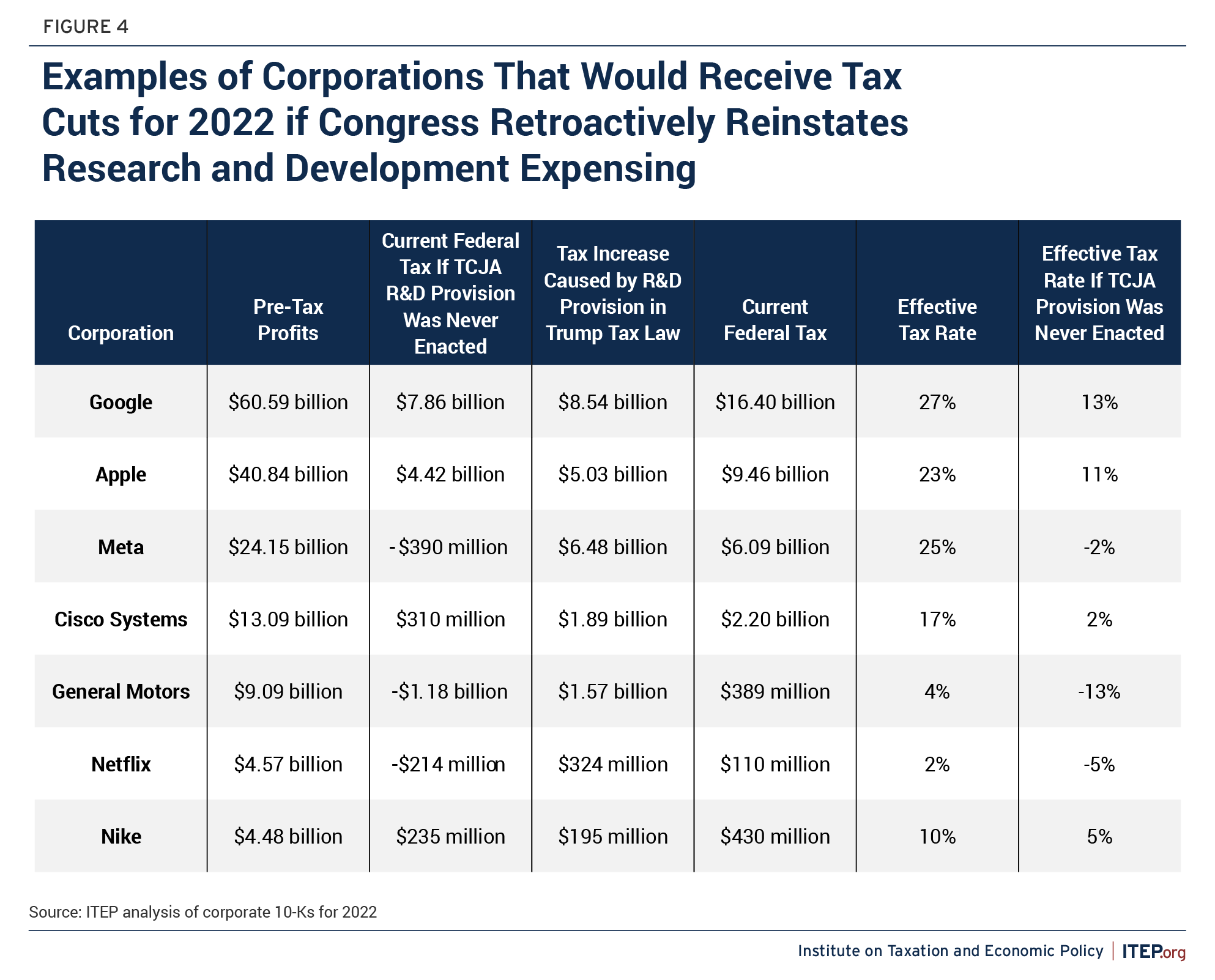

The Tax Relief for American Families and Workers Act of 2024

Source : www.wolterskluwer.com

Proposed Tax Deal Would Help Millions of Kids with Child Tax

Source : itep.org

Retroactive Tax Credits 2024 California State Retroactive Filing for Employee Retention Tax Credit Is Ongoing : If you live in one of these states, you could be getting another child tax credit payment in addition to the federal amount. . Tax season always seems to start off with some kind of quirky, what-if component. This year, the what-if involves the possible expansion of the child tax credit, which likely would be retroactive .